The first was regarding the allegation that Mendu Rammohan Rao, dean of the Indian School of Business, one of the independent directors of Satyam, was not consulted before calling off the Maytas acquisition. This issue raises questions on the corporate governance followed at the leading IT company of India.

To placate the investors and regain the lost trust, Satyam announced that it will consider issue of dividends to the shareholders. There was also the news of a possible buyback of shares. Both of these proposals will be decided upon during the board meeting on 29th December. If we look the comparative figure of the dividend history of top Indian IT companies like Infosys, Wipro and TCS, alongside that of Satyam, the observation that strikes us is that Satyam has never been a huge dividend distributor. Its dividend rate has been a flat 175% in the last few years.

(Source: Capitaline database)

(Source: Capitaline database)Click on image to enlarge

Click on image to enlarge

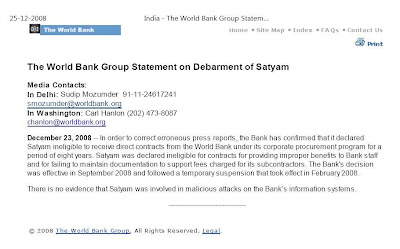

And then came the worst of them all, but this time it was no rumour ! The World Bank had barred Satyam Computer Services from doing any businesswith it for the next eight years. During the last five years, the World Bank had paid Satyam hundreds of millions of dollars for its global IT maintenance and service. There was a slew of rumours this time, as to the actual reason of this harsh action. But, as is clear from the World Bank group statement, Satyam was debarred for providing improper benefits to Bank staff (i.e. Bribery) and for failing to maintain proper documentation. The bank also verified that Satyam was not involved in malicious attacks on the Bank’s information systems, as was rumoured. So, for now the one-week high powered drama seems to have subsided, but what took 22 years to build was surely dented in a few days time.